WASHINGTON, D.C. (December 2, 2023) – The U.S. Environmental Protection Agency (EPA) has finalized methane pollution standards for new and existing oil and gas facilities that include gas wells, compressor stations and storage tanks. These updated environmental regulations will increase required air pollution inspections at oil and gas facilities while requiring widely available control technologies that do not emit climate-warming methane gas directly to the atmosphere. Methane has 87 times the global warming potential of carbon dioxide over a 20-year time period.

Additionally, this rule will require reducing smog-causing volatile organic compound (VOC) emissions as well as air toxic emissions like the known carcinogen benzene. The rule will also include a Super-Emitter Response Program that will provide information regarding air pollution incidents, and their resolutions, to impacted communities.

Joseph Otis Minott, Clean Air Council Executive Director and Chief Counsel issued the following statement:

“President Biden and the EPA are taking meaningful action with rules that set a strong foundation for cutting methane pollution from new and existing oil and gas operations. We look forward to supporting Governor Shapiro in tailoring these rules to ensure they adequately address the concerns of Pennsylvania residents near gas operations. As the second largest producer of fossil gas in the country, Pennsylvania has an outsized responsibility to cut as much climate-warming methane emissions from the gas industry as possible and better protect the health of people living near oil and gas operations.”

PHILADELPHIA, PA (August 12, 2022)

This afternoon, the U.S. House of Representatives voted to adopt the Inflation Reduction Act of 2022, a budget reconciliation bill that was approved by the U.S. Senate earlier this week. The bill, which contains $369 billion in climate and clean energy investments, and which preliminary modeling analysis shows will reduce U.S. greenhouse gas emissions by roughly 40% (from 2005 levels) by 2030, will now be sent to President Biden’s desk for his signature.

Image from a preliminary report prepared by Princeton University’s REPEAT Project

Joseph Otis Minott, Esq., Clean Air Council Executive Director and Chief Counsel, issued the following statement:

“After nearly two years of negotiations and stalemates, our country can take a deep breath, bask in this moment, and celebrate the fact that we finally have a historic climate bill that will move the country towards meaningful climate action. While no piece of legislation is perfect, the Inflation Reduction Act will make a historic $369 billion investment in climate change solutions, create millions of high-paying jobs in building America’s clean energy economy, and help prevent thousands of premature deaths by 2030. This bill is a game changer and a much-needed step in the right direction as most Americans are already facing the devastating impacts of climate change.”

“Especially critical for Pennsylvania, the nation’s second largest producer of fossil gas, the IRA will put a price on climate-warming methane pollution from the oil and gas industry, starting at $900 a ton in 2024 and increasing to $1,500 a ton for companies that fail to comply with EPA’s upcoming pollution standards for new and existing oil and gas facilities. This is an essential complementary tool for reducing methane emissions, which are already causing 30% of the global warming that we are experiencing today. We are also excited to see at least $60 billion of investments for programs prioritized by environmental justice communities and advocates.”

“Because this moment arrived after such long, difficult negotiations, we must also acknowledge this is a compromise bill. It does contain troubling giveaways to the fossil fuel industry and could threaten communities that have already suffered disproportionate impacts from fossil fuel pollution. Clean Air Council plans to closely analyze the forthcoming separate bill resulting from these negotiations that will deal with permit reforms. Still, even as the fight to protect against the worst impacts from climate change moves forward, we can breathe a well-deserved sigh of relief that the historic amount of good included in this bill far outweighs the bad. Today is a day to celebrate long-awaited federal climate action.”

HARRISBURG, PA (July 8, 2022) – Today, the Commonwealth Court of Pennsylvania granted a preliminary injunction halting the carbon budget and trading rule that allows Pennsylvania to participate in the Regional Greenhouse Gas Initiative, or RGGI. This cap-and-invest system would reduce carbon pollution from Pennsylvania’s power plants by up to 227 million tons by 2030, according to the Department of Environmental Protection, as well as add $2 billion to our Gross Domestic Product and 30,000 jobs to our economy. This delay threatens to derail critically-needed investment to address climate change and reduce air pollution across the state.

The following reaction is from PennFuture Senior Attorney Jessica O’Neill, lead attorney for PennFuture, Clean Air Council, Sierra Club, Environmental Defense Fund, and Natural Resources Defense Council:

“While only temporary, the court’s decision is yet another roadblock and stalling tactic from RGGI opponents.The impact that RGGI will have on the health, safety, and welfare of our members, our climate, and our environment cannot be overstated. Simply put, RGGI will save lives, create jobs, and lower Pennsylvania’s carbon footprint at a time when we need it most.

“We expect the Department of Environmental Protection to appeal today’s ruling, which means the Supreme Court will have the opportunity to reinstate the RGGI rule. It doesn’t stop here – we will continue to fight. We eagerly anticipate our next opportunity to defend this rule, which will unquestionably save lives by improving air quality and is necessary to cut Pennsylvania’s significant carbon footprint from the power sector.”

On June 28, the Commonwealth Court also denied the environmental groups’ request to intervene in the lawsuits. Ms. O’Neill, on behalf of the organizations, issued the following statement regarding the denial of their intervention in these critical cases:

“By denying our organizations the ability to participate in RGGI litigation, our important environmental interests have been improperly ignored by the Commonwealth Court. We have been working for years to advance necessary regulations to reduce carbon emissions in Pennsylvania, and RGGI is a critical component to reach our goal of net-zero carbon emissions by 2050. We are exploring all options in relation to the denial of our right to participate in these matters and will continue to fight for Pennsylvania’s carbon budget and trade rule and for our constitutional right to clean air.”

The legal challenges to Pennsylvania’s RGGI rule still remain before the Commonwealth Court in McDonnell v. PA Legis. Review Bd. (41 MD 2022) and Bowfin, et al. v. PA Dept. of Envir. Protection (247 MD 2022).

Sean Deresh is an undergraduate student in the Vagelos Integrated Program in Energy Research studying Earth Science in the College of Arts and Sciences and Chemical and Biomolecular Engineering in the School of Engineering and Applied Science at the University of Pennsylvania. He is a volunteer advocate with the Clean Air Council, a member of Penn Sustainability’s Student Advisory Group for the Environment, and a research assistant at Penn’s Kleinman Center for Energy Policy.

Sean is interested in the future direction of the global oil market and what factors might help reduce our reliance on oil as a primary energy source.

Recent fluctuations of the oil industry: a call for energy policies that embrace renewable development

Given the magnitude of the impending effects of climate change, many sectors have begun to explore alternative avenues for energy consumption that either reduce or eliminate greenhouse gas emissions. Crude oil, one of the primary fossil fuels, has proven to become a driving force in the US energy industry due to its high energy density and low cost. The current US energy policy landscape is still in a transitional phase, and as the Biden administration continues to set goals for expanding renewable energy supply in the US, it is only a matter of time before oil dependency is minimized. The volatility of the global oil market due to drastic fluctuations in supply and demand and recent geopolitical tensions are clear indicators that energy policy must be restructured to help foster a landscape that is not so dependent on oil and can withstand potential changes in energy resource supply. Oil prices are currently hovering around $100 per barrel due to a combination of upward pricing pressure on concerns of reduced Russian oil supply and fears of a renewed COVID-19 economic attenuation in China24. A decline in US oil inventories is putting even more pressure on the price of oil as the nation’s strategic reserve is depleted and the Russia-Ukraine war continues. Through time, mass electrification will inevitably emerge as one of the primary solutions to high gas prices, as global oil trends favor enhanced clean development.

The current dilemma

The balance of international power is a key factor in the oil industry, with the future fortunes of countries such as Russia and Iran tied to crude oil. Geopolitical tensions and the disparity between supply and demand have led to an increase in the price of crude oil. Prices increased by more than 15% in January, as the global benchmark price crossed $90/b for the first time in over seven years, as fears of Russian invasions in Ukraine grew14. Upon the Russian invasion of Ukraine, the price of crude oil rose to nearly $96/bbl and Brent crude — the global benchmark for oil prices — went as high as $105.79 for the front-month contract20. The tension between Russia and the West is growing and President Putin is willing to take geopolitical risks to assert his power. If Russian production is interrupted, the US, Japan, European countries, and China could release mode crude oil from their reserves in the event of a crisis. This invasion has caused many entities such as the EIA and investment banking firms to increase their oil price predictions.

Energy experts and E.U. Officials have expressed that Russia’s invasion of Ukraine is poised to add more urgency to Europe’s efforts to reduce its dependence on Russian oil and gas and to compel Europe to speed up its transition to renewable energy. Discussions of accelerating the transition toward alternative sources of energy began months ago as oil and gas prices began to rise and recently intensified as tensions grew closer to war with Russia. The recent invasion of Ukraine then increased the risk of Europe’s reliance on Russian gas. For instance, Germany, which has been ramping up its wind and solar capacity and shuttered coal-fired and nuclear facilities, has viewed natural gas as a reliable fuel that can get the country through the transition. However, Germany currently receives about half of its gas supply through pipelines from Russia and does not have the infrastructure to take shipments of liquefied natural gas (LNG) from other sources. As Russia’s gas flows have slowed, Germany’s feeling of reliability has shifted.

The energy transition will be easier for some countries in Europe than others. Some countries could actually return to polluting fuels such as coal-reliant Poland, as renewables still have a long way to go there and it might not seem feasible to meet demand amidst such heightened geopolitical tensions and risks. If the alternative is to stay on course with decarbonization at the expense of high energy prices or vulnerability, this will be hard to achieve, and compromises that will soften climate ambitions set out by the E.U. will have to be established. A European gap without gas could mean relying more on coal and sources such as nuclear by bringing them back online or reducing demand among households and the industry. An E.U. plan to tax carbon-intensive imported goods could have costly impacts on countries such as China and Russia, which have weaker environmental regulations. Absolutely everything could change if the invasion expands beyond Ukraine, and depending on how long this conflict lasts, it could affect U.N. climate talks when countries revise goals for reducing emissions. Geopolitical tensions could drive Russia toward China or even into isolation. If sanctions affect Russia’s access to the markets in the West, they will have to seek other economic opportunities. Losing Europe as a major customer would leave Russia with few options to sell its gas in the short term.

The crude oil landscape

In recent years, American consumers have been facing a sustained increase in prices for oil products1. As a global commodity and primary source of fuel for the global economy, crude oil has a price that is determined by both supply and demand, reflects buyer-seller interactions1, and has recently experienced an unprecedented shift amidst the COVID-19 pandemic. The primary activities required to move crude oil from source to consumer include production, refining, distribution, and marketing1, and such activities take place in the global marketplace. The world currently consumes over 97 million barrels of oil per day2, and its proven reserves are equivalent to 46.6 times its annual consumption levels, suggesting that planet Earth has 47 years of oil left under current consumption rates2. This would be the equivalent of going above and beyond the “business as usual” emissions scenario of global circulation models, resulting in the strongest possible set of climate change effects18.

The global oil market is complex. Various countries currently produce oil, but only a few of them dominate production3. Nearly 100 countries produce crude oil around the globe, but in 2020, only five of them accounted for 50% of the world’s total crude oil production: United States with 15%, Russia with 13%, Saudi Arabia with 12%, Iraq with 6%, and Canada with 5%4. There are three types of companies that supply crude oil in the global market4. International oil companies (IOCs) such as ExxonMobil, BP, and Royal Dutch are investor-owned. National oil companies (NOCs) are extensions of government or government agencies and include companies such as Saudi Aramco (Saudi Arabia), Pemex (Mexico), the China National Petroleum Corporation (CNPC), etc. The Organization of Petroleum Exporting Countries (OPEC), an international cartel of oil-producing countries, is the most powerful production-level entity. In 2020, OPEC’s members held 71% of the world’s total proven crude oil reserves and accounted for 36% of total world crude oil production4.

Crude oil is bought and sold throughout a chain of distribution and its price is a function of supply and demand conditions, which are more important in determining the price of oil than trade flows in the long term. Recent changes in supply and demand have increased the prices paid by retailers and consumers for crude oil.

Looking ahead

The burning of gasoline and diesel are primary forces for global warming. As the years progress, the world will indubitably continue to perpetuate the transition toward clean energy sources and reduce its reliance on oil. Fortunes could be made or lost from shifts in the energy economy, which is controlled by some of the largest private and state corporations in the world. Oil companies will be at the forefront of change and undercut their own businesses. Regardless, there are still clear indications that the global demand for oil will peak and decline by the late 2030s11.

Electric vehicles certainly have the potential to drive the crude oil market towards a new trend against its perpetuation as an energy source. Federal transportation and energy officials recently detailed where the first millions of the government’s $7.5 billion funding for electric vehicle charging infrastructure will go, laying the foundation of a system that could establish where Americans fuel for decades to come19.

Western oil companies, under pressure from investors and environmental activism, are drilling less oil wells than before the pandemic restrained supply increases. Biden has been urging OPEC to pump more oil, and OPEC’s members and their allies have recently agreed to plan to increase production14. The Biden administration also announced that it would release 50 million barrels of oil from its strategic reserves to relieve pressure put on consumers. These recent calls for OPEC to increase production amidst increased demand is not consistent with his ideals of carbon neutrality and emissions reductions. The Biden administration continues to refuse to confront the oil industry even though it continues to develop at an outstanding pace. As the uncertainty of the future oil market grows given recent events, the Biden administration must consider environmental justice in its development of new initiatives to reduce the intensity of the instability of the oil industry.

Recent changes in supply and demand have increased the prices paid by retailers and consumers for crude oil. By the end of 2022, the price of crude oil will have increased due to the recovery from strained supply caused by the COVID-19 pandemic, the initiation of increased production from OPEC members, and tensions between foreign nations. Near 2030, oil demand will begin to peak as consumption growth diminishes and global inventories are greatly replenished, causing the price of crude oil to decrease. It might sound like a long time, but in the grand scheme of things it would be beneficial for the Biden administration to develop regulatory reforms that limit or inhibit oil extraction and development so as to initiate a decay in the Nation’s dependence on the source.

Energy policy outlook23

- We must develop novel energy policies that embrace renewable energy for electricity generation to achieve significant carbon pollution reductions by midcentury.

The US needs to do more to avert the impacts of climate change. Meeting climate goals will require the implementation of new policies that control emissions of carbon and other greenhouse gases. The US cannot simply rely on fossil fuels in the way it has in the past. By adopting sustainable policies, the US has the potential to generate a large portion of its electricity from zero-carbon emitting sources by the target dates. Strong domestic cooperation will be needed to facilitate international action. The US electricity sector is responsible for a large percentage of the nation’s carbon dioxide emissions. Long-term dependence on fossil fuels for power generation is incompatible with the response needed to mitigate the impacts of climate change. Renewable energy is booming but still lags behind traditional fuels. Policymakers must promote the rapid decarbonization of the power sector and the deployment of renewable energy technology.

- We must invest in safe, resilient, and reliable energy infrastructure.

Decisions that policymakers make today will last for decades to come. The modern electricity grid must accommodate expanded and diverse generation from renewable energy sources and provide reliable service. In the future, reliability will go hand in hand with ensuring that our energy infrastructure is resilient to the impacts of climate change, such as extreme weather. All energy infrastructure (pipelines, railroads, production facilities, etc.) should adhere to the highest standards of public safety so as to ensure proper climate action.

- We must reduce the transportation sector’s dependence on oil.

In order to meet the nation’s emission reduction goals, the US needs to continue to make cars and trucks cleaner and more efficient. The US should envision moving away from a transportation sector that is highly dependent on oil to one that relies on alternative energy sources, electricity being one of them. Manufacturers have already developed low-emission or zero-emission vehicles, and new technologies are appearing every year. Policymakers should provide consumers and governments with incentives to continue the transition to a cleaner transportation system.

- We must empower the energy consumer by ensuring equitable access to clean energy.

Energy policy is about more than supply and demand and market interactions. As technology and innovation change to the energy industry, consumers will have new opportunities to benefit from clean technologies to lower their energy costs. Consumers should be free to make sustainable energy decisions, such as installing solar panels or purchasing an electric car, without paying ridiculous fees that are designed to inhibit development. A clean energy economy must also be inclusive in that consumers from all income levels should have the opportunity to experience the benefits of clean energy technology.

- We must balance the impacts of energy production with the protections of citizens’ public lands and fair returns to taxpayers.

Oil and gas drilling, coal mining, and even renewable energy production in some cases, all have environmental costs associated with them. Policymakers should minimize these impacts by deciding which locations are appropriate for development and which are simply not feasible. Energy development should be balanced with protections for landscapes, the reinvestment of energy revenues in the conservation of land, water, and wildlife, and the enforcement of mitigation and reclamation requirements. Public lands and waters belong to all citizens, so taxpayers should be compensated for the extraction and development of their energy resources.

Email: sderesh@sas.upenn.edu

References

- Grant, Kenneth, et al. “Understanding Today’s Crude Oil and Product Markets.” Lexecon, an FTI Company, 2006, https://www.heartland.org/_template-assets/documents/publications/19500.pdf.

- “Oil Consumption by Country 2022.” World Population Review, https://worldpopulationreview.com/country-rankings/oil-consumption-by-country.

- “Frequently Asked Questions (FAQS).” U.S. Energy Information Administration (EIA), 8 Dec. 2021, https://www.eia.gov/tools/faqs/faq.php?id=709&%3Bt=6.

- “Oil and Petroleum Products Explained, Where Our Oil Comes From.” U.S. Energy Information Administration (EIA), 8 Apr. 2021, https://www.eia.gov/energyexplained/oil-and-petroleum-products/where-our-oil-comes-from.php.

- “Energy & Financial Markets: What Drives Crude Oil Prices?” U.S. Energy Information Administration (EIA), https://www.eia.gov/finance/markets/crudeoil/.

- “Short-Term Energy Outlook.” U.S. Energy Information Administration (EIA), 11 Jan. 2022, https://www.eia.gov/outlooks/steo/.

- “EIA Forecasts Crude Oil Prices Will Decline during 2022.” U.S. Energy Information Administration (EIA), 18 Nov. 2021, https://www.eia.gov/todayinenergy/detail.php?id=50396#:~:text=We%20expect%20that%20the%20price,%2462%2Fb%20in%20December%202022.

- “EIA Forecasts Crude Oil Prices Will Fall in 2022 and 2023.” U.S. Energy Information Administration (EIA), 12 Jan. 2022, https://www.eia.gov/todayinenergy/detail.php?id=50858#:~:text=In%20our%20January%202022%20Short,%2479%20per%20barrel%20(b).

- Shalett, Lisa. “Rising Oil Prices Pose Risks.” Morgan Stanley, 29 Apr. 2019, https://www.morganstanley.com/ideas/rising-oil-prices-pose-risks.

- Egan, Matt. “Oil Prices Will Surge to $100 This Year, Goldman Sachs Warns.” CNN, Cable News Network, 18 Jan. 2022, https://www.cnn.com/2022/01/18/energy/oil-prices/index.html.

- Krauss, Clifford. “Foretelling the Future of Oil.” The New York Times, The New York Times, 9 Oct. 2018, https://www.nytimes.com/2018/10/09/business/foretelling-the-future-of-oil.html.

- Rapier, Robert. “Saudi Arabia Proves That Oil Is Power.” Forbes, Forbes Magazine, 24 Oct. 2018, https://www.forbes.com/sites/rrapier/2018/10/24/saudi-arabia-proves-that-oil-is-power/?sh=6645fdf342e8.

- Neuhauser, Alan. “Why Oil Forecasts Keep Getting It Wrong | National News …” U.S. News, 25 Sept. 2018, https://www.usnews.com/news/national-news/articles/2018-09-25/why-oil-forecasts-keep-getting-it-wrong

- Krauss, Clifford. “Why Are Oil Prices So High and Will They Stay That Way?” The New York Times, 2 Feb. 2022, https://www.nytimes.com/2022/02/02/business/economy/oil-price.html.

- Urbi, Jaden. “Here’s What Drives the Price of Oil.” CNBC, 17 May 2018, https://www.cnbc.com/2018/05/15/what-drives-oil-prices.html.

- “Factors Influencing Crude Oil Price.” Factors Influencing Crude Oil Price | EBF 301: Global Finance for the Earth, Energy, and Materials Industries, Penn State College of Earth and Mineral Sciences, https://www.e-education.psu.edu/ebf301/node/752.

- “Oil Price Charts.” OilPrice.com, https://oilprice.com/oil-price-charts/#WTI-Crude.

- “20 Questions and Answers”. Climate Change Evidence and Causes, https://www.nap.edu/resource/25733/interactive/.

- “Biden Admin Details First Contours of EV Charging Network.” Subscriber.politicopro.com, https://subscriber.politicopro.com/article/eenews/2022/02/10/biden-admin-details-first-contours-of-ev-charging-network-00007610.

- Domonoske, Camila. “Oil Surges Past $100 a Barrel after Russia Invades Ukraine.” NPR, NPR, 24 Feb. 2022, https://www.npr.org/2022/02/24/1082571179/oil-surges-past-100-a-barrel-after-russia-invades-ukraine.

- U.S. Energy Information Administration – EIA – independent statistics and analysis. (2022, February 8). Retrieved March 4, 2022, from https://www.eia.gov/outlooks/steo/.

- Allen, N. (2022, March 18). Morgan Stanley Ups Oil Price Forecast, again. SeekingAlpha. https://seekingalpha.com/news/3814548-morgan-stanley-raises-oil-price-forecast-again.

- “Key Principles for an Energy Policy that Meets U.S. Environmental and Economic Needs” The Center for American Progress, 26 Oct. 2015.

- Rittmeyer, Brian. “Oil Market Volatility Brings End to Declining Gas Prices, Analysts Say”. TRIB Live. 25 April, 2022. https://triblive.com/local/regional/oil-market-volatility-brings-end-to-declining-gas-prices-analysts-say/.

Image sources:

https://www.maxpixel.net/Solar-Panel-Renewable-Energy-Sun-Renewable-Energy-3191780

October 5, 2021 – A serious and growing problem has been leaking to the surface for decades, resulting in significant amounts of greenhouse gas pollution and other contaminants harming Pennsylvania’s air, soil, and water. Companies have been extracting oil and gas from drilled wells in Pennsylvania since the 19th century – long before our government attempted to keep track of them or enforce permitting and plugging requirements. As a result, hundreds of thousands of unplugged orphan and abandoned wells dot the landscape, leaking methane, oil, and volatile organic compounds (VOCs) to this day. State law distinguishes between wells classified as orphan or abandoned. These wells, left behind by defunct companies or with no known owner, are in dire need of remediation and have become a significant liability for state taxpayers. The facts are sobering.

Pennsylvania is estimated to have anywhere from 200,000 to 560,000 orphan and abandoned oil and gas wells. Despite their age, these wells leak significant amounts of methane every year. Methane is up to 87 times more potent as a heat-trapping gas than carbon dioxide over a 20-year timeline. Pennsylvania’s Department of Environmental Protection (DEP) has thus far documented only around 8,700 of these wells given the agency’s limited resources. Orphan wells can be found in strange places: along riverbanks, deep in the woods, even inside people’s homes. The uncontrolled release of gas and liquids from unplugged wells is fouling water supplies, polluting the air, and creating a serious safety hazard for those living nearby.

Although DEP’s efforts to address this problem have been admirable, the agency simply cannot manage this crisis with its current resources. According to the Department, it has only about $400,000 a year and a small grant program to spend on this. Meanwhile, the true costs of plugging wells are staggering. All wells are different and, while DEP has conservatively estimated an average plugging cost of $33,000 per well, costs can easily add up to hundreds of thousands of dollars for a single well.

The solution is much more complicated than simply “capping” a well by placing something on top. The key is to isolate each flow zone, corrosive zone, and water zone to prevent vertical migration of fluids, which is done by injecting cement and placing plugs throughout the wellbore at strategic spots. Without that, you would see significant methane migration in the subsurface (with houses and coal mines occasionally blowing up). Most well plugging programs focus more on addressing emergency conditions as they arise, rather than broadly tackling the problem, which must include a massive undertaking to identify undocumented wells.

So what can be done? Pennsylvania’s expected participation in the Regional Greenhouse Gas Initiative (RGGI) beginning in early 2022 provides an opportunity. Linking with RGGI is projected to generate hundreds of millions in annual proceeds for Pennsylvania, which can be reinvested in programs to further eliminate air pollution. Without question, orphan well plugging merits a reasonable share of those funds. New technology is available to make accurate estimates of emissions and establish a set of high priority wells. An efficient well-plugging program can tackle these problem wells, plugging up to 1,000 of them per year. Wells that are dry or are leaking very small amounts can be left for later. RGGI funds will likely be available to DEP as early as Q1 2022, and Pennsylvania currently has plenty of bench strength in well plugging manpower, experience, and capability.

At the federal level, President Biden called on Congress in the spring to allocate $16 billion to plug old oil and gas wells and clean up abandoned mines as part of his Build Back Better agenda. When the US Senate passed the $550 billion Bipartisan Infrastructure Framework in early August (by a vote of 69-30), the bill included roughly $5 billion dedicated to plugging orphan wells. Funding at this scale is a great down payment, as Pennsylvania appears to be eligible for up to $600 million over the next ten years. Some of those funds can also be spent on identifying and prioritizing undocumented orphans.

The legislation is now in the House and, consistent with the plans of President Biden and Democratic leadership, its passage is currently linked with the more comprehensive reconciliation package still being negotiated. To be clear, the big, bold climate investments in the reconciliation bill are absolutely critical and necessary. They represent perhaps our last chance to address climate change legislatively this decade. We do not have another decade to waste! Enacting both pieces of legislation would be a historic victory for the country and the people of Pennsylvania on multiple fronts, including the major funds for orphan well plugging.

All in all, cleaning up our air, water and soil while creating good-paying jobs and, most critically, significantly curbing greenhouse gas emissions by documenting and plugging orphan wells is a key priority for Clean Air Council.

Robert M. Routh, Esq.

Public Policy and Regulatory Attorney

rrouth@cleanair.org

The Path to Deep Decarbonization in Pennsylvania

July 6, 2021– The climate crisis is accelerating and intensifying. An alarming new analysis released in mid-June by NASA and NOAA found that the planet is trapping roughly double the amount of heat in the atmosphere that it did just 15 years ago. We know that climate tipping points could trigger other climate tipping points in a domino effect, leading to irreversible impacts. Earth has already warmed roughly 1.1 degrees Celsius since the 19th century. Even if we magically zeroed out all greenhouse gas (GHG) emissions tomorrow, that warming is baked in for decades. Thankfully, we have the tools available to save lives and prevent the worst impacts from being felt. But we need to enact sweeping policy changes now and over the course of this decade to make that happen.

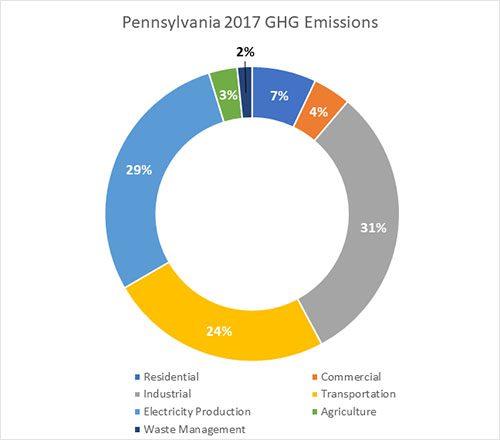

In Pennsylvania, historically a major fossil fuel state, key sources of GHG pollution can be broken down into these categories:

- electricity generators (coal-fired and fracked gas-fired power plants);

- industrial activities (e.g., fracked gas extraction and processing, iron and steel production, cement manufacturing);

- transportation sources;

- residential and commercial buildings, and

- agriculture

To oversimplify things, here’s a two-step path to dramatically curb emissions: (1) decarbonize the electricity sector; and (2) then electrify everything. There will be countless complementary policy measures needed to implement that plan (and not everything can be easily electrified) but it’s a solid framework to guide our efforts.

To help decarbonize Pennsylvania’s electric sector, Governor Wolf directed the Department of Environmental Protection (PADEP) to draft rules to establish a CO2 Budget Trading Program and allow the Commonwealth to participate in the Regional Greenhouse Gas Initiative (RGGI) beginning in 2022. RGGI is a collaborative effort between 11 neighboring states that uses a market-based auction approach to put a price on carbon for polluting power plants. RGGI states have seen their power sector carbon pollution cut in half since 2009. PADEP projects that RGGI participation will cut up to 227 million tons of CO2 by 2030, while generating hundreds of millions of dollars in annual proceeds for reinvestment in Pennsylvania businesses and communities. This is a strong first step.

Pennsylvania would also benefit from President Biden’s proposed Energy Efficiency and Clean Electricity Standard (EECES) – which aims to fully decarbonize America’s electricity sector by 2035 – and by the U.S. Environmental Protection Agency’s (EPA) plans to reinstate a strengthened version of President Obama’s Clean Power Plan. In March, Governor Wolf also announced a major public-private partnership (called “PULSE”) to install seven new solar arrays in counties across Pennsylvania that will supply nearly half the electricity used by state government. This project will go into operation beginning January 1, 2023, and represents the largest commitment to solar energy by any government in the U.S. That’s a decent start for the electricity sector.

Pennsylvania also needs to significantly invest in expanding our electric vehicle (EV) charging infrastructure and accelerate consumer knowledge and adoption of EVs. In February, PADEP announced it intends to promulgate a proposed Zero Emission Vehicle (ZEV) rulemaking later this year, which would require automakers and dealerships in Pennsylvania to sell a certain amount of electric cars and trucks. However, it’s not enough to simply change motors in the vehicles we drive. We need to incentivize transportation mode shifting by making substantial investments in public transit, railways, bike trails, and walkable corridors in our cities and suburbs.

On the industrial side, Pennsylvania is the second-largest fracked gas producing state in the country. Our gas industry emits over 1.1 million tons of methane pollution every year. Methane, the primary component of fracked gas, is an extremely potent climate pollutant and leaks across every stage of the gas supply chain. PADEP is finalizing a rulemaking to control methane emissions from existing infrastructure (well sites, compressor stations, and processing plants), but the proposal currently exempts so-called “low-producing” wells from routine inspection requirements. In practice, this means over half the methane emissions from existing sources will continue to go unchecked. Clean Air Council helped deliver tens of thousands of comments during the public comment period last year urging PADEP to close this loophole.

The Biden EPA is also planning to draft federal methane rules for existing sources, which we anticipate seeing introduced as early as September 2021. Those have enormous potential to reduce Pennsylvania emissions. So too would the $16 billion called for by President Biden in his American Jobs Plan to plug orphaned wells and clean up abandoned mine lands. Pennsylvania has hundreds of thousands of orphaned gas wells (the vast majority of which aren’t even documented) that desperately need funding to plug up methane that’s been leaking for decades.

Finally, about 11% of Pennsylvania’s GHG pollution comes from burning fossil fuels to heat space and water in our residential homes and commercial buildings. In Philadelphia, our building stock contributes more than 70% of the city’s GHG emissions. We need to move quickly to incentivize all-electric construction in new buildings, while taking bold steps to retrofit and electrify our existing buildings. This can happen at the municipal level, where Philadelphia is conducting a Diversification Study to examine the future of Philadelphia Gas Works, the nation’s largest municipally owned fracked gas utility. It can also happen at the federal level, where another key component of President Biden’s American Jobs Plan would invest billions in retrofitting our nation’s homes and buildings.

Clean Air Council has been directly involved in all the various legal and policy issues surrounding these plans in the past year. There is so much that needs to happen and quickly. Thankfully, we have a solid grasp on how to reach our goals and these multifaceted efforts should work in tandem to drive down emissions. It’ll be the challenge of our lifetimes, and it’s already begun.

For more information, please contact:

Robert M. Routh, Esq.

Public Policy and Regulatory Attorney

rrouth@cleanair.org

By Joseph Otis Minott, Esq.

Pennsylvania Department of Environmental Protection (DEP) Secretary Patrick McDonnell will appear before the Senate Appropriations Committee on Wednesday, March 4 at 10:00 AM to present Governor Wolf’s 2020-21 budget request for the department.

Ahead of this hearing, we took a look at some of the claims and spin from industry-boosters during the Secretary’s appearance before the PA House Appropriations Committee last week.

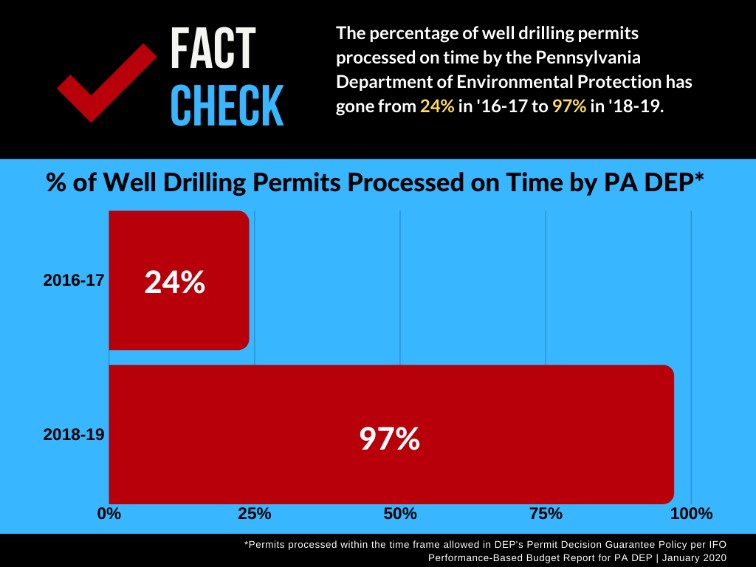

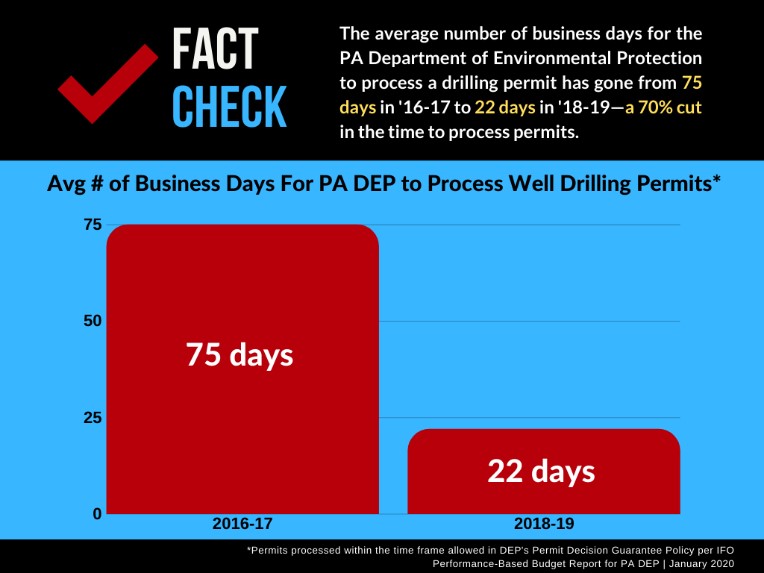

Contrary to outdated rhetoric, the PA Department of Environmental Protection has nearly eliminated the permit backlog

Rep. Keith Greiner (R-Lancaster County) raised the importance of eliminating DEP’s historical well-drilling permit application backlog but cites outdated – and misleading – numbers. There was indeed a DEP permit backlog in July 2017, caused in part by deficient permit applications filed by industry consultants. The good news is that, today, the backlog has been all but eliminated.

After DEP publicly committed itself to reducing the permit backlog, the number of backlogged permits has been cut from 8,715 down to 512 by December 2019. That is a backlog reduction of 94%. Considering that there are often questions and issues that arise in the permitting process that may lengthen the review time in order to ensure health and safety, that is tremendous progress.

DEP’s commitment to speed up permit review comes through in the numbers:

- The percentage of well drilling permits processed on time has gone from 24% in 2016-17 to 97% in 2018-19

- The average number of business days to process a drilling permit has gone from 75 days in 2016-17 to 22 days in 2018-19, a 70% reduction

- In the SW region, processing time dropped from 112 days in 2016-17 to 27 days in 2018-19

As Rep. Greiner noted, “we want good numbers when we make budget decisions . . .”

Well, if you are the oil and gas industry, you should be pretty happy with those numbers.

Pennsylvania’s methane problem gets downplayed, state representative focuses on downstream emissions

Rep. Jesse Topper (R – Bedford/Franklin/Fulton) discussed what he called a 12 percent reduction in methane levels since 2005, which he stated (quoting the EPA) was “largely due to decreases in emissions from distribution, transmission and storage of natural gas.”

For a few reasons, that statement is incomplete and leads to the false conclusion that no additional action is needed to control methane emissions.

First, that statistic does not reflect methane emissions from the oil and gas upstream production, where the vast majority of emissions are produced. Consequently, Gov. Tom Wolf has proposed a rule that would cut methane emissions from the thousands of existing sources of oil and gas pollution in Pennsylvania, including well sites and compressor stations, which constitute the bulk of the methane pollution problem in the commonwealth.

Second, according to EPA estimates, methane emissions have decreased only 1 percent over the last several years. Industry is simply not getting the job done.

More importantly though, EPA estimates vastly understate methane pollution. According to a 2018 Environmental Defense Fund analysis, oil and gas-related methane emissions in Pennsylvania are estimated to be five times higher than industry-reported data, totaling a whopping 520,000 tons of methane per year. The annual climate impact of this pollution is greater than that from all of the cars in Pennsylvania combined.

The bottom line: Gov. Wolf and DEP are on the case, taking concrete action. Pennsylvania remains the second-largest natural gas producing state in the U.S. and third-largest greenhouse gas polluting state in the nation, and significant improvement is essential to reduce its role in contributing to climate change. Cherry-picking stats to mislead and misrepresent real progress does not help Pennsylvanians or anyone supporting climate action.

Joseph Otis Minott is the Executive Director and Chief Counsel of Clean Air Council.

On Friday, Governor Wolf and the Department of Environmental Protection issued a ban on the issuance of water and earth-moving permits and approvals for Energy Transfer pipelines in Pennsylvania.

In response, Joseph Otis Minott, Esq. Executive Director and Chief Counsel of Clean Air Council, issued the following statement:

“The ban on new permits to Energy Transfer is the kind of leadership on pipelines that the public has been waiting for from Governor Wolf. This was a crucial step to protect the public from a company with a track record of environmental destruction, public safety disasters, and deception. The next logical step is to stop the operation of ET’s Mariner East pipelines for good.”

Click here to read the full press statement from Governor Wolf

[PHILADELPHIA, PA – September 20, 2018] Today, the Kleinman Center for Energy Policy released “Beyond Bankruptcy: The Outlook for Philadelphia’s Neighborhood Refinery,” a report that raises concerns about contamination at the Philadelphia Energy Solutions (PES) refinery site and highlights the utter lack of public participation in the remediation planning process.

According to the report, Sunoco did not follow the required public participation process for remediation planning, as local residents, city agencies, elected officials, and other stakeholders were not able to provide input. The Pennsylvania Department of Environmental Protection (DEP) has already approved Sunoco’s analysis of contamination for eight of the eleven refinery sites deemed an “area of concern,” meaning Sunoco may comply with weaker pollution standards.

Joseph Otis Minott, Esq., Executive Director and Chief Counsel of Clean Air Council, issued the following statement:

“Sunoco has unlawfully denied local residents, city agencies, elected officials, and other stakeholders the opportunity to meaningfully provide input during the remediation planning process for the PES refinery site. The lack of public participation in planning for remediation at the site is completely unacceptable, especially given the extensive environmental contamination at the site and the proximity of the refinery to environmental justice neighborhoods. As PES is likely to go bankrupt again in the near future, it is critical that the city engage the public in thoroughly assessing the best possible future use of the refinery site that aligns with Philadelphia’s sustainability goals.”

###

Clean Air Council is a member- supported, non-profit environmental organization dedicated to protecting everyone’s right to a healthy environment. The Council is headquartered in Philadelphia and works through public education, community advocacy, and government oversight to ensure enforcement of environmental laws. For more information, please visit www.cleanair.org.

PHOTO: Kleinman Center for Energy Policy

[PHILADELPHIA, PA – September 18, 2018] Today, U.S. Department of Interior Secretary Ryan Zinke announced a final rule effectively gutting methane pollution standards for natural gas facilities on public and tribal lands. The move eviscerates an Obama-era rule designed to reduce natural gas from venting, flaring, and leaking at oil and gas operations. The original version, adopted in 2016, would have lowered greenhouse gas emissions, improved air quality and the health of residents living near operations, and saved $33 million in tax revenue that would have otherwise been lost entirely (according to estimates by the Bureau of Land Management).

Before 2016, these standards had not been updated for over three decades, and the impact of rolling them back will not be limited to the Western States. Pennsylvania is home to almost 10,000 acres of federal land leased for oil and gas operations, nearly 5,000 of which are producing acres.

Joseph Otis Minott, Esq., Executive Director and Chief Counsel of Clean Air Council, issued the following statement:

“Interior Secretary Ryan Zinke has chosen to steamroll impacted communities, the American public, and bipartisan opposition in Congress by gutting the BLM methane waste rule. Zinke’s decision threatens public health, exacerbates threats to our climate, and takes revenue away from taxpayers. In Pennsylvania, this will affect the nearly 10,000 acres of federal land leased for oil and gas development, essentially guaranteeing additional methane pollution from gas infrastructure there. This action only emphasizes the need for continued state-level leadership to cut methane, like we saw from Governor Wolf this year when he finalized methane permits for new and modified sources. This rollback also calls into serious question the role natural gas can play in an increasingly competitive energy landscape, where a premium is placed on both economic efficiency and environmental outcomes.”

###