PAY-PER-MILE / NON-OWNER AUTO INSURANCE

SAVE MONEY AND HELP THE ENVIRONMENT BY DRIVING LESS

Pay-per-mile (PPM) auto insurance is a win-win for car owners and the environment. You’ll save money as you keep CO2 out of the atmosphere. The Council recognizes that doing away with one’s car is not possible for most of us, but PPM is a simple consumer choice that changes how we think about the way we use our cars. If widely adopted, PPM could contribute to a significant reduction in the region’s carbon output.

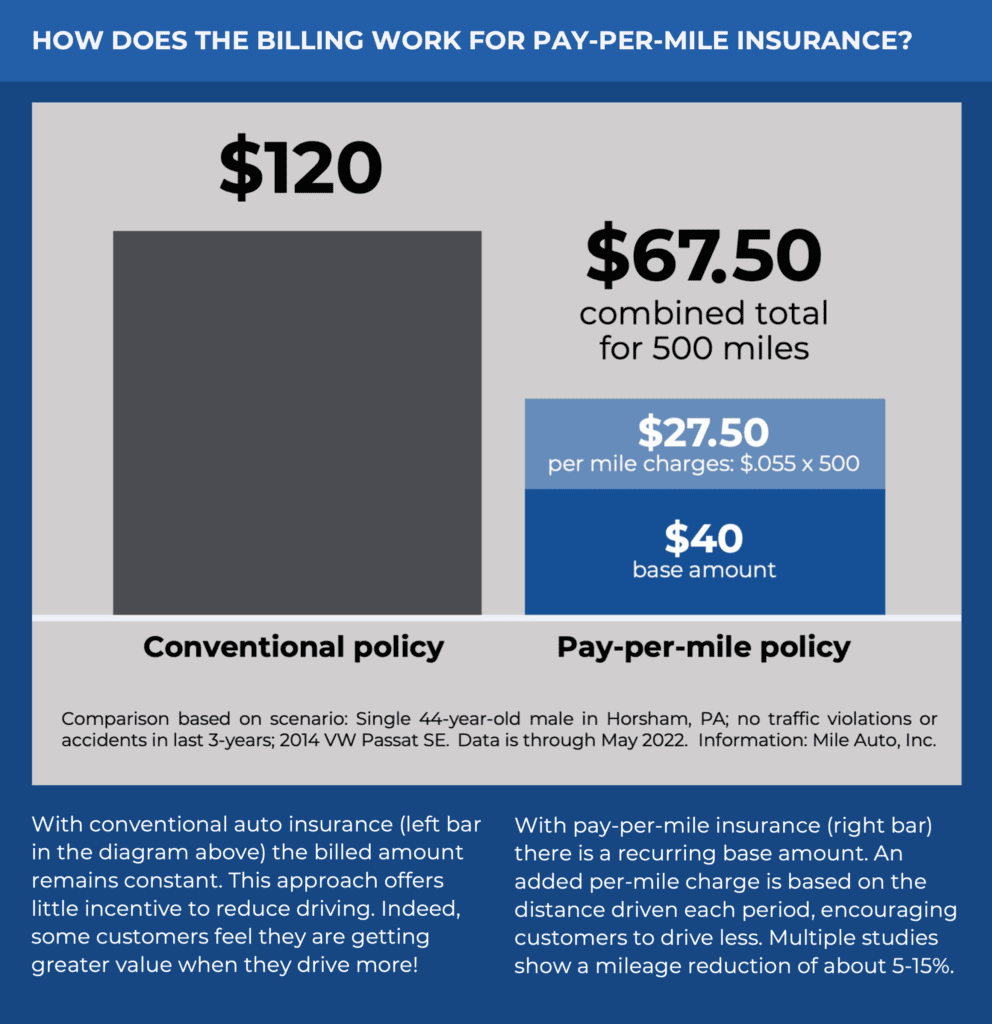

Unlike fuel, conventional auto insurance costs the same amount each month, no matter how much you drive. PPM turns insurance, a major fixed cost of auto operation, into a variable one that you control. You’re rewarded for reducing the miles that you drive each month.

Studies from US Department of Transportation and a range of experts have shown that car owners with insurance that’s linked to mileage do drive less, by about 5-15%. This means this one simple change can be an effective strategy for reducing transportation emissions, even at an individual level.

POSITIVE IMPACTS OF PAY-PER-MILE INSURANCE

Less driving achieves these important personal, societal, and environmental benefits:

Car owners save money because they are only insuring the miles they actually drive. This is particularly significant during the pandemic when many Americans are driving less than before.

Congestion and drive times will be reduced. Reducing miles driven means fewer cars on the road. Reducing congestion means the cars left on the road are waiting in traffic less and getting better fuel economy, which is good for the planet.

It is more sustainable. Several studies from the US and Canada have confirmed that pricing insurance by the mile reduces energy consumption, carbon, and other pollution emissions.

Less driving means safer streets. A 2010 study of PPM insurance commissioned by a leading US environmental group found a strong relationship between miles driven and crash claims.

It’s more equitable because distance-based auto insurance corrects for inherent subsidies from lower-annual-mileage-customers to higher ones. Multiple studies have noted this feature, with one stating that such insurance products are “progressive with respect to income, since lower-income motorists tend to drive less than average.”

IS PAY-PER-MILE INSURANCE RIGHT FOR YOU?

Consumers should consider some form of distance-based auto insurance if they are driving less than the US average of 13,500 miles per year (pre-pandemic). Indeed, those who work from home, are a student or a retiree, or regularly commute on foot, by bike or on public transit may see a big reduction in their monthly insurance premium. It may also make sense in a two-car household if one vehicle is driven much less than the other. Many Clean Air Council members who are conscious of how much they drive could take advantage of savings.

People who don’t own a car, but rent or share them, may want to consider non-owner coverage, offered by some insurers. Such coverage, when it includes medical and related benefits, is popular with pedestrians and cyclists, some of whom don’t have driver’s licenses.

WITH PAY-PER-MILE INSURANCE,

YOU STILL NEED TO MIND THE BASICS

When shopping for PPM insurance that is comparable to your current coverage, it is important to check that all the limits for liability, comprehensive, collision and uninsured motorist coverage are the same or better than what you have now. Changing to a different billing format should not cause any of your current benefits or coverage levels to decrease.

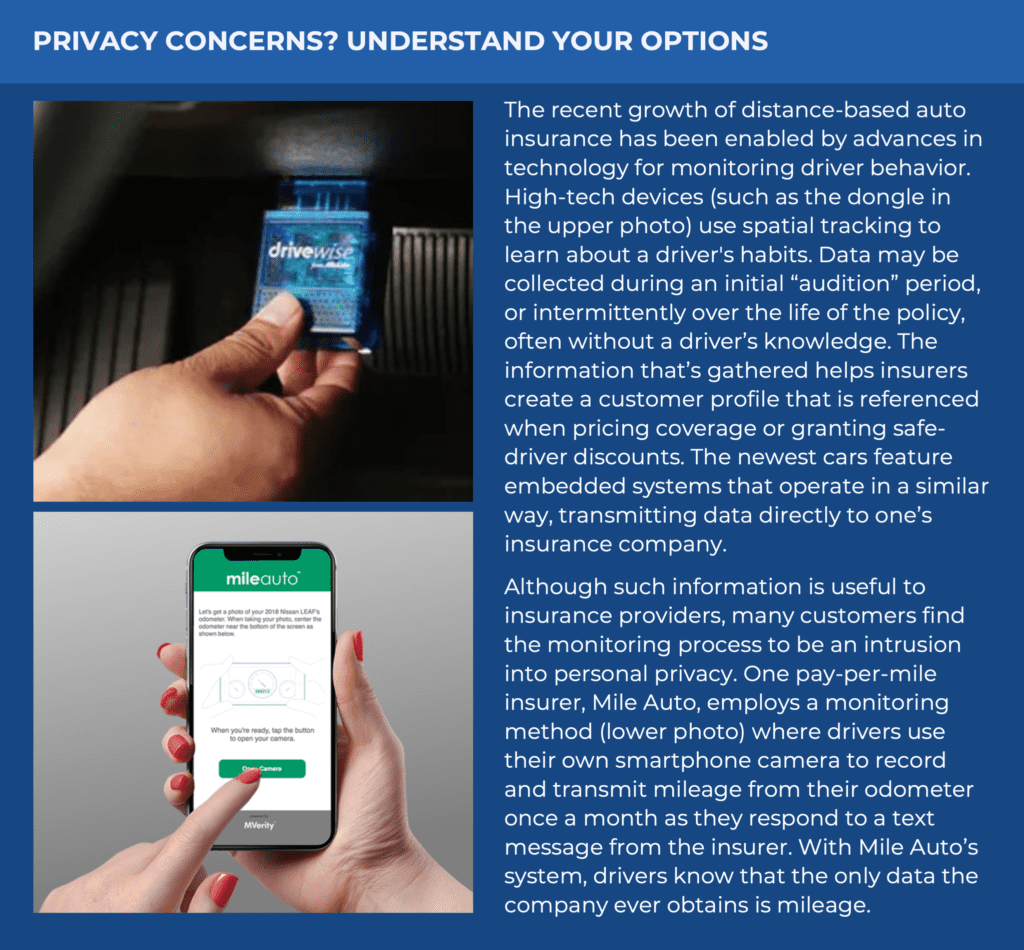

Also, be aware that some PPM insurers collect more personal data than just your mileage. A wide range of technologies are employed, with pros and cons related to privacy and safety connected to each.

If you are thinking about making a change to your insurance, it is important to note that you don’t need to wait until your current policy is expiring. States generally require insurers to provide a full refund for any unused portion of a policy, so you can change insurance whenever it’s convenient for you.

YOUR INSURANCE HELPS TO SUPPORT OUR PROGRAMS

Pay-Per-Mile insurance benefits Clean Air Council in two ways:

It advances our mission because with PPM insurance you are likely to drive less, thus reducing GHG emissions into the region’s air.

It provides financial support to the Council. Binding coverage through the link below, provided as a courtesy to our constituents, helps to fund programs that enable us to continue to protect everyone’s right to a healthy environment.

If you are a low-mileage driver (or are currently driving less due to the pandemic), now is a great time to consider the environmental benefits and monetary rewards that can be achieved by switching to pay-per-mile or non-owner insurance. Clean Air Council is pleased to connect you to a licensed insurance entity to learn how much you can save. The process is easy, simple and quick.

The insurance-related information on this website is provided to you as an educational service. It includes information gathered from sources that were judged to be accurate and reliable at the time of publication. Clean Air Council makes no representation regarding the current accuracy of such information. Insurance offerings mentioned above may not be available in all states. Brand names referenced above are the property of their respective copyright holders. Specific coverages for any insurance policy are described in the contract governing that policy in a given state, and not on this website. The link above, and phone number below, to Mile Auto, a licensed insurance firm, is provided as a convenience. By binding insurance coverage from Mile Auto, based on a quote provided via this online portal or toll-free number, you are agreeing to share your mileage and contact information with Clean Air Council (a SmartGO Network organization), SmartGO (a national nonprofit organization) and/or other SmartGO Network organizations. In doing so, you may become eligible for a range of TDM (transportation demand management) incentives and rewards. The primary goal of such benefits is to reduce auto use by traveling less, carpooling, walking, biking, and using public transit more. Neither Clean Air Council, SmartGO, nor any SmartGO Network organization is an insurer. Mile Auto provides financial support directly to SmartGO, and to Clean Air Council indirectly through SmartGO. 100% of the funding from this source is used to advance our nonprofit mission. Clean Air Council and SmartGO encourage you to obtain multiple quotes for the insurance that is most suitable to your needs, preferences and budget. For answers to auto insurance-related questions or for a quote, call Mile Auto toll-free at: 1-844-238-9881